Understanding Duration

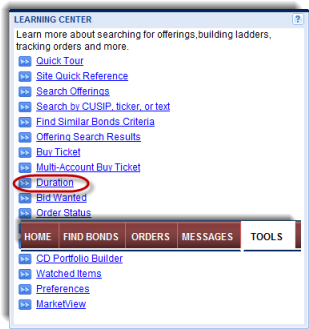

The "Understanding Duration"

tip sheet in the BondWorks Learning Center

on the Tools page comprehensively explains how

interest rate changes affect bond prices. This tip sheet includes several

charts that graphically illustrate duration and its affects. Below is

a condensed version of information contained in the tip sheet.

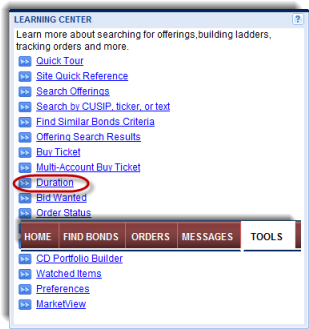

The "Understanding Duration"

tip sheet in the BondWorks Learning Center

on the Tools page comprehensively explains how

interest rate changes affect bond prices. This tip sheet includes several

charts that graphically illustrate duration and its affects. Below is

a condensed version of information contained in the tip sheet.

A fixed income investment consists of a series of cash flows an investor

receives over the life of a bond. These cash flows can be in one of the

following forms:

Coupons (periodic interest payments)

Periodic return of principal (available with some mortgage backed

or structured asset bonds)

Return of principal at final maturity or an earlier call date.

The size, timing and frequency of these cash flow payments influence

all bond calculations, including duration which can be described as “the

average time it takes to get your money back."

Types of Duration

Duration values change as market values change and time passes. The

practical duration measures below define the boundaries of potential price

movement (volatility) for possible price/yield values on any given date.

Each applies to an approximate 1% change (100 basis points) in the yield

calculation specified.

Modified Duration to the Earliest Call—Yield change calculated to

the earliest call date; the most conservative and least price movement

given a 1% change in interest rates.

Modified Duration to Worst—Yield change calculated to

the priced to worst date; generally used to reflect the behavioral characteristics

of a bond as of a specific price/yield and date; consistent with industry

calculations, always calculated to the priced to worst date, including

all call features.

Modified Duration to Maturity—Yield

change calculated to final maturity date. This reflects the most aggressive

and greatest price movement given a 1% change in interest rates.

The "Understanding Duration"

tip sheet in the BondWorks Learning Center

on the Tools page comprehensively explains how

interest rate changes affect bond prices. This tip sheet includes several

charts that graphically illustrate duration and its affects. Below is

a condensed version of information contained in the tip sheet.

The "Understanding Duration"

tip sheet in the BondWorks Learning Center

on the Tools page comprehensively explains how

interest rate changes affect bond prices. This tip sheet includes several

charts that graphically illustrate duration and its affects. Below is

a condensed version of information contained in the tip sheet.